Benjamin Lowy/Getty Images

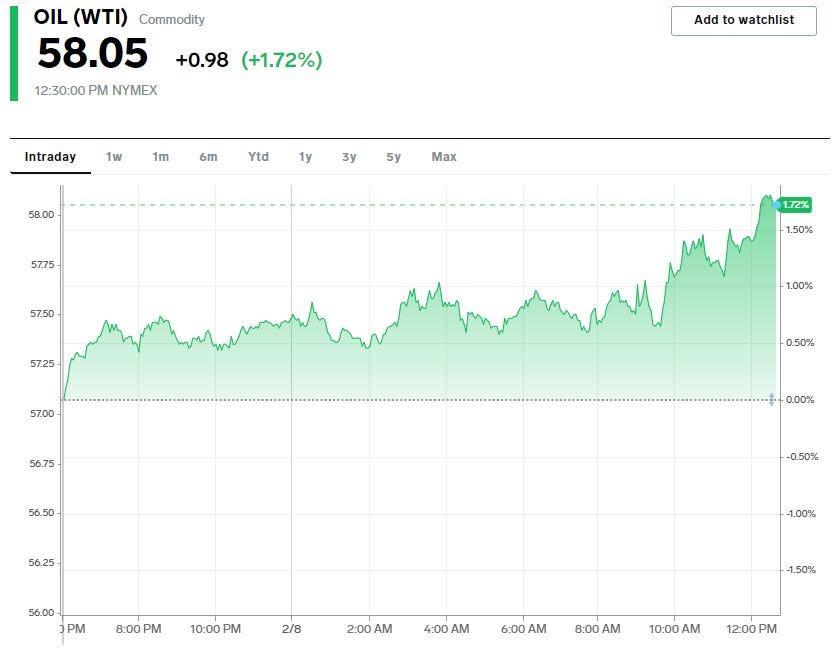

- WTI Crude and Brent oil surged 2% on Monday to hit their highest levels in more than a year.

- The recovery in oil prices has been driven by an expected boost in demand as COVID-19 vaccines allow the economy to open up and enable more traveling among consumers.

- Oil supply has also tightened in recent weeks as Saudi Arabia cut its production levels.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Oil prices spiked 2% on Monday and hit their highest level in more than a year as tightening supply and an expected recovery in demand brightened a recently grim outlook for the industry.

WTI Crude Oil traded up 2.3% to $58.14 per barrel in Monday afternoon trades, while Brent Crude jumped 2.1% to $60.60.

Oil hasn’t traded this high since January 2020, right before the COVID-19 pandemic represented a significant risk to markets and the economy.

But the rollout of COVID-19 vaccines from Pfizer and Moderna are boosting expectations that a return in demand for oil is imminent as consumers begin to travel again.

According to Bloomberg’s vaccine tracker, more than 2 million Americans were vaccinated on Saturday, and more than 42 million Americans have already received at least one dose of the vaccine. Daily COVID cases also fell below the 100,000 mark on Sunday, marking the lowest number daily cases in over three months.

As COVID cases continue to decline and vaccinations continue to increase, pent-up demand from consumers will likely be unleashed on the economy as more and more people feel comfortable traveling and gathering.

A recovery in travel is important for oil, as transportation via cars and planes represents the biggest source of demand for the commodity.

On top of that, oil supply has tightened in recent weeks with Saudi Arabia cutting its daily oil production for February and March.

The sustained rally in oil represents an incredible turn in sentiment after the commodity traded at negative prices less than a year ago due to both a collapse in demand and a supply glut.